Stockholder RecommendationsOther Potential Benefits. The Board of Directors believes that a higher stock price would help VirnetX attract and Nomineesretain employees and other service providers. It is the view of the Board of Directors that some potential employees and service providers are less likely to work for a company with a low stock price, regardless of the size of the company’s market capitalization. Accordingly, if the reverse stock split successfully increases the per share price of the common stock, the Board of Directors believes this increase will enhance VirnetX’s ability to attract and retain employees and service providers.

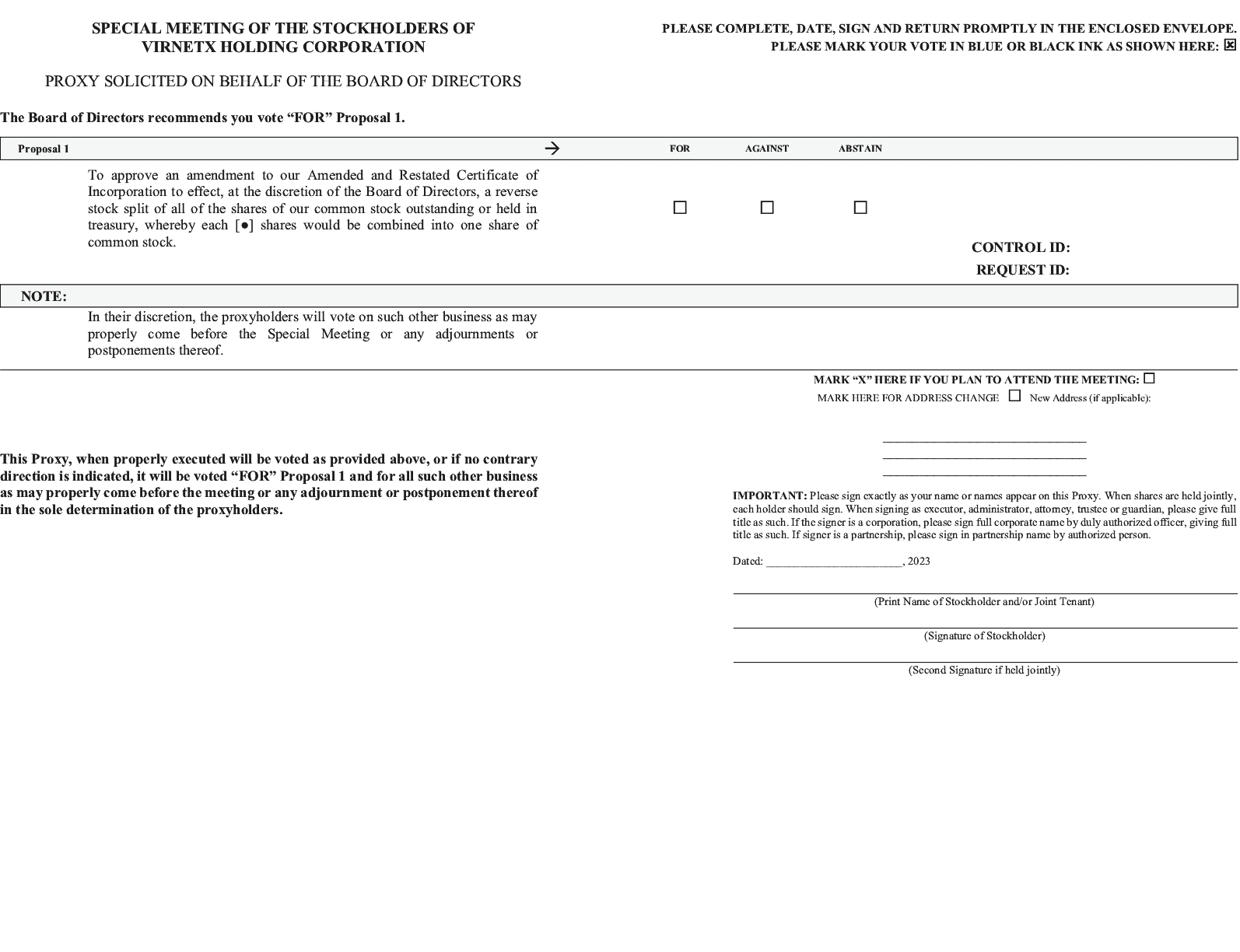

Risks Associated with the Reverse Stock Split There are certain risks associated with a reverse stock split, including those described below, and we cannot accurately predict or assure you that the reverse stock split will produce or maintain the desired results. However, our Board of Directors believes that the benefits to us and our stockholders outweigh the risks and recommends that you vote in favor of the reverse stock split proposal.

The policyreverse stock split could result in a significant devaluation of our nominatingVirnetX’s market capitalization and corporate governance committeetrading price of the common stock.

The Board of Directors expects that a reverse stock split of the common stock outstanding or held in treasury will increase the market price of the common stock. However, VirnetX cannot be certain whether the reverse stock split would lead to a sustained increase in the trading price or the trading market for the common stock. The history of similar stock split combinations for companies in like circumstances is to consider properly submitted recommendations for candidatesvaried. There is no assurance that:

the market price per share of the common stock after the reverse stock split will rise in proportion to the Board from stockholders. In evaluating such recommendations, our nominatingreduction in the number of pre-split shares of common stock outstanding before the reverse stock split;

the reverse stock split will result in a per share price that will attract brokers and corporate governance committee seeksinvestors, including institutional investors, who do not trade in lower priced stocks;

the reverse stock split will result in a per share price that will increase VirnetX’s ability to achieveattract and retain employees and other service providers;

the market price per post-split share will remain in excess of the $1.00 minimum closing price as required by the NYSE continued listing standards or that VirnetX would otherwise meet the requirements of NYSE for continued inclusion for trading on NYSE; and

the reverse stock split will increase the trading market for the common stock, particularly if the stock price does not increase as a balanceresult of experience, knowledge, integrity, and capability on the Board and to addressreduction in the membership criteria set forth under “Director Qualifications” below. Any stockholder recommendations for consideration by our nominating and corporate governance committee should include (1) the name, age, business address and residence address of such person, (2) the principal occupation or employment of such person, (3) the class and number of shares of the Company that are beneficially owned by such person, and (4) any other information relating to such person that is required to be disclosed in solicitations of proxies for election of directors, or is otherwise required, in each case pursuant to Regulation 14A under the Exchange Act (including, without limitation, such person’s written consent to being namedcommon stock available in the Proxy Statementpublic market.

The market price of the common stock will also be based on VirnetX’s performance and other factors, some of which are unrelated to the number of shares outstanding. If the reverse stock split is consummated and the trading price of the common stock declines, the percentage decline as an absolute number and as a nomineepercentage of VirnetX’s overall market capitalization may be greater than would occur in the absence of the reverse stock split. Furthermore, the liquidity of the common stock could be adversely affected by the reduced number of shares that would be outstanding after the reverse stock split and to serving as a director if elected).

Stockholder recommendationsthis could have an adverse effect on the market price of the common stock. If the market price of the common stock declines subsequent to the Board should be sent to our Corporate Secretary at VirnetX Holding Corporation, P.O. Box 439, Zephyr Cove, Nevada 89448.

In addition, our Bylaws permit stockholders to nominate directors for consideration at an annual meeting of stockholders. For a descriptioneffectiveness of the process for nominating directorsreverse stock split, this will detrimentally impact VirnetX’s market capitalization and the market value of VirnetX’s public float.

The reverse stock split may result in accordance with our Bylaws, see “How do I submitsome stockholders owning “odd lots” that may be more difficult to sell or require greater transaction costs per share to sell.

The reverse stock split may result in some stockholders owning “odd lots” of less than 100 shares of common stock on a stockholder proposal forpost-split basis. These odd lots may be more difficult to sell, or require greater transaction costs per share to sell, than shares in “round lots” of even multiples of 100 shares.

Because of the 2023 Annual Meeting of Stockholders?” of this Proxy Statement and our Bylaws whichreverse stock split ratio, certain stockholders may no longer have been filed with the SEC.any equity interest in VirnetX.

Director Qualifications

Our nominating and corporate governance committee evaluates and recommends candidates for membershipBased on the Board consistent with criteria established byreverse stock split ratio of 1-for-[•], certain stockholders might be fully cashed out in the Board. The Board hasreverse stock split and thus, after the reverse stock split takes effect, such stockholders would no longer have any equity interest in VirnetX and therefore would not formally established any specific, minimum qualifications that must be met by each candidate for the Boardparticipate in our future earnings or specific qualities or skills that are necessary for one or more of the members of the Board. However, our nominating and corporate governance committee, when considering a potential candidate, will factor into its determination the following qualities of a candidate, among others: educational background, professional experience, including whether the person is a current or former chief executive officer or chief financial officer of a public company or the head of a division of a large international organization, knowledge of our business, integrity, professional reputation, independence, wisdom, and ability to represent the best interests of our stockholders, diversity, and with respect to diversity, such factors as gender, race, ethnicity and experience, area of expertise, potential conflicts of interest and other commitments and other individual qualities and attributes that contribute to the total mix of viewpoints and experience represented on the Board.

Identification and Evaluation of Nominees for Directors

Our nominating and corporate governance committee uses a variety of methods for identifying and evaluating nominees for any position on the Board. Our nominating and corporate governance committee regularly assesses the appropriate size and composition of the Board, the needs of the Board, the respective committees of the Board, and the qualifications of candidates in light of these needs. Candidates may come to the attention of the nominating and corporate governance committee through stockholders, management, current members of the Board, or third-party search firms engaged by the nominating and corporate governance committee.

Once the nominating and corporate governance committee has identified a prospective nominee, the nominating and corporate governance committee makes an initial determination as to whether to conduct a full evaluation of the candidate. This initial determination is based on the information provided to the nominating and corporate governance committee concerning the prospective candidate, as well as the nominating and corporate governance committee’s own knowledge of the prospective candidate, which may be supplemented by inquiries to the person making the recommendation or others. If the nominating and corporate governance committee determines, in consultation with other Board members as appropriate, that additional consideration is warranted, it may gather or request the third-party search firm to gather additional information about the prospective nominee’s background and experience. The nominating and corporate governance committee then evaluates the prospective nominee, taking into account whether the prospective nominee is independent within the meaning of the listing standards of NYSE and such other factors as it deems relevant, including the current composition of the Board, the balance of management and independent directors, the need for audit committee or compensation committee expertise, the prospective nominee’s qualifications as discussed above, the diversity of the member’s skills and experience in areas that aregrowth, if any.